Travel medical insurance is often an afterthought when planning for a vacation trip. For many people, young people especially, insurance seems like a scam. Perhaps they went on a trip or two with no accidents and think to themselves, why the heck did I buy insurance? They think because they’re young, strong, and healthy, that they won’t ever need to file a claim. If people are already this resistant to getting insurance in general, how much less likely will people get comprehensive travel insurance that also covers snorkeling and scuba diving accidents?

Did you know that few travel insurance plans even cover snorkeling and scuba diving accidents? Once we started taking traveling and scuba diving seriously, we were shocked to find out that our go-to travel and medical insurance provider only covered general activities. If anything had happened to us in the water, if we survived to tell the tale, we would also have been on the hook for a hefty bill. You need to carefully look for insurance that covers scuba diving and snorkeling if that’s what you’ll be doing on your vacation.

Perhaps you, too, are now in the same boat as we were. You may be planning on going on many snorkeling and scuba diving vacations and are researching which insurance provider to go with. In that case, since most insurance plans exclude snorkeling and scuba diving coverage, in this article, we will go over the best ones that do cover these activities in their insurance plans.

Are you willing to snorkel or dive without insurance?

If you don’t have insurance, or you have a travel insurance plan that doesn’t cover snorkeling or scuba activities, then if you were to get injured in the water you will be on the hook for 100% of the medical bills related to that incident.

In the U.S. and perhaps abroad, that bill could be in the thousands or tens of thousands of dollars depending on the treatment you received; this is quite literally life-ruining amounts of debt. You’d almost wish you didn’t survive your accident.

With that said, both snorkeling and even scuba diving are considered to be relatively safe activities when done correctly. However, the only predictable thing about this world is that it’s sure to be unpredictable. Crazy injuries can happen when doing even the most basic things.

It’s hard to enjoy a vacation if the threat of debt is always lingering in the back of your mind. In our experience, it’s better to get an insurance plan that specifically covers the activities we’ll be doing on our trip so we can have peace of mind and just do what we want without worrying so much.

Does regular medical insurance cover scuba diving?

When we were doing our research, one of the first questions we asked our insurance provider was whether or not we were covered for injuries that happened while snorkeling and scuba diving. The answer we received was complicated and may not necessarily apply to you. Here’s what we were told.

Since we are American citizens with U.S. health insurance, as long as we were injured in the United States, then our injuries would be covered according to the terms of our insurance plan. So if we got hurt snorkeling in Florida or Hawaii, it would be treated just like if we were injured at home.

The coverage would be the same, and we would have to deal with the same kinds of co-pays, deductibles, and other insurance lingo that probably sounds like gibberish to people outside of the U.S. Our recommendation is to call your insurance provider and confirm with them whether or not you would be covered for snorkeling or scuba/snuba diving accidents domestically.

However, if we’re talking about getting coverage internationally, then that’s a different story. Most U.S. based medical insurance plans, including even Medicare and Medicaid, provide little to no coverage for hospital bills you rack up abroad.

If you were unlucky enough to be seriously injured while traveling abroad without medical insurance, the bills will be enormous. For instance, if treatment required you to be transported to another city or country with the resources to treat your injury, the transportation costs alone could cost tens of thousands of dollars, as high as hundreds of thousands of dollars. That doesn’t even include the cost of the treatment!

So unless your regular medical insurance offers sufficient international medical coverage (ours does not), then you need to purchase specific travel insurance that does cover your medical expenses (all of them, including injuries sustained from snorkeling and scuba diving) while you’re vacationing abroad.

Does travel insurance cover snorkeling and scuba diving?

There are various types of travel insurance. For instance, cancellation or trip delay insurance only applies if you had to pay an unexpected expense due to your trip being cancelled or delayed. Some insurance only covers for damaged or lost luggage while you were traveling. This is really useful if you brought along expensive scuba and snorkel gear like a camera, laptop, or BCD, or a prescription mask.

What you’re specifically interested in is the medical coverage of your travel insurance. Most travel insurance will cover general medical expenses, however not all of them specifically cover snorkeling or scuba diving as mentioned above. Many insurance providers consider them to be a type of “extreme sport” that is specifically excluded from coverage if you read the fineprint.

That’s the reason why we are even writing this article. We realized we weren’t as covered as we thought and had to figure out which travel insurance provider could cover our “extreme” lifestyle. This isn’t easy, since you will have to brush up on your legalese comprehension skills as you comb through the fineprint, or you’ll have to call the company and pray the customer service is competent. So, be glad that it’s been done for you.

Which travel insurance company covers snorkeling and scuba diving?

We’ve used numerous travel insurance companies over the years, and after painstaking research, we’ve gotten really good at figuring out which ones actually cover scuba diving. Two companies specifically have stood out to us, but we also provide a brief review of some others for comparison’s sake.

World Nomads

If you are under 70 years of age, travel all over the world, and would like to be more adventurous while doing so, then we highly recommend World Nomads Travel Insurance.

They meet this review’s criteria of covering snorkeling and scuba diving accidents, and in fact World Nomads insurance covers a whole lot more. You would have to be trying pretty hard to do something so wild that it isn’t covered by their insurance plan (see the full list here). As you can see, snorkeling and scuba diving are covered under their Standard plan. More advanced forms of diving such as commercial or cavern diving are still covered under their Explorer plan.

World Nomads insurance plans have so much coverage, you’d be hard pressed to find something it doesn’t cover. From that list, it seems only base jumping and mountaineering are out. It’s no surprise that World Nomads is so popular with frequent travelers, digital nomads, backpackers, and so on. They even provide coverage for pregnant women, which is something you rarely find from an insurance provider.

You can get a free automatic quote online directly from their website. It’s fast and super easy to do. We almost always use World Nomads for our travel insurance whenever we travel internationally. They are our go-to because the prices they quote us are affordable, and for the wide range of activities they cover, it’s a steal.

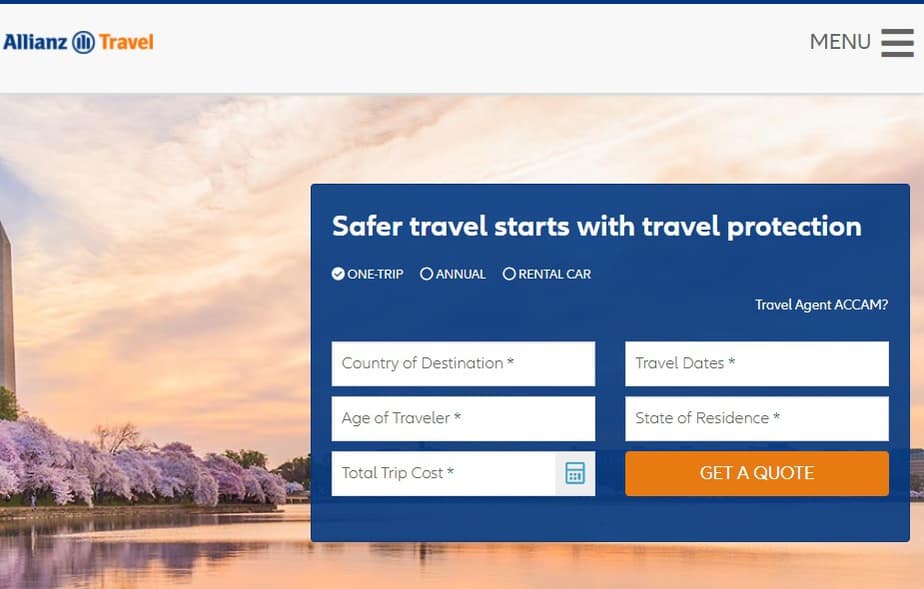

Allianz Travel Insurance

Sometimes we use Allianz when it’s a better fit for our group profile. They are probably the best choice for U.S. based travelers that are over 70 years of age.

It wasn’t clear whether they covered snorkeling and scuba diving, and the representative we talked to confirmed that they did, assuming these activities were performed in a safe manner. For instance, scuba divers should always be with a divemaster and not exceed depths of 60 feet. Snorkelers should be wearing some kind of flotation device, and so on. As long as you weren’t being reckless, you should be covered under their travel medical plan.

With scuba diving and snorkeling covered, like World Nomads, their travel medical plans cover more than just water sports accidents. Their higher tier plans don’t cost much more and provide even better coverage. Based on online reviews, they are known for their excellent customer service and ease of claims processing.

To get started, Allianz can provide you with an automatic online quote if you give them a few pieces of information (age, state of residence, travel dates, destination, and trip cost). If you or anyone in your group is over the age of 70, Allianz will provide some of the best rates available.

How to pick a dive insurance policy

Looking to do some insurance shopping on your own? Or perhaps you’re not happy with the choices we provided, and want to know what criteria we were following to come up with these choices? In this section, we will go over the top criteria to look out for when selecting a dive insurance policy.

Deciding on which travel insurance to get is perhaps the least exciting part of trip planning. Rather than wade through a wall of indecipherable text, don’t you just wish it was written in plain English? We can’t translate it for you (we struggle with it ourselves) but we can at least tell you what to look out for.

Coverage

The confusing part of travel insurance is figuring out what it does and doesn’t cover, and how much they will reimburse you if you file a legitimate claim. We were very pleased to see that World Nomads provided a huge list of what activities they do cover. Not every insurance provider is this transparent, however.

You may have to look at the fineprint, particularly at what’s excluded. There will be variations between plans provided by different insurance providers, as well as to what extent. Even if scuba diving and snorkeling is covered, what are the limits of the coverage?

If you are severely injured and need an emergency evacuation, the bill can be in the hundreds of thousands of dollars. When looking at the amounts that insurance providers are willing to pay for transportation costs, look for ones that are either unlimited or a sum in the hundreds of thousands of dollars.

Check if your dive insurance will also cover accommodation or travel that is required due to your accident. For instance, it’s not unusual for someone to need to stay an extra week or more to heal before they are fit to travel home.

Depth limits

Just because an insurance provider covers scuba diving injuries doesn’t mean it will cover all of them. There are limits you have to dive within. For instance, a basic plan may only cover you if you dive with air and only to a depth of 30 meters (100 feet). But what if you dive with an enriched gas mix, such as Nitrox? Or if you went deeper than 30 meters?

Depending on the type of diving you do, such as cave or wreck diving, you will definitely need a higher tier plan. There may also be a depth limit for these types of diving too. You must stay within the limits outlined in the fineprint otherwise the insurance provider will not cover you.

Travel restrictions

Check that the destination you are planning on traveling to is not on your government’s travel restriction list. If you’re based in the United States, check out the travel advisories provided by the U.S. State Department. There are various warning levels, and the level at which your insurance becomes invalid has to be pretty high. This varies between providers, so check directly with them.

Note: Hopefully this will no longer be the case for you, dear reader, but this article was written during the COVID-19 pandemic. As you can see from the travel advisory, it’s not a particularly good time to be traveling.

Time restrictions

If you’ll be spending many months abroad, you’re going to need some long-term coverage. It’s much more cost-efficient if you [purchase an annual plan instead of a single-trip plan. If you plan on going on three or more trips a year, then that is when it makes sense to get a long-term plan. You’ll have to check with your insurance provider to see how long their plans last for.

Some insurance policies say they’ll cover you for a year, but only if each trip is 90 days or less. So if you’re planning on going around the world, you might suddenly find yourself out of coverage. If you’re planning on going on a one-off trip, just stick with the short-term plans.

Parting Words

There are many factors that go into finding comprehensive travel insurance in general, and adding snorkeling and scuba diving into the mix just complicates matters even more. However, once you get an idea of what to look for, you can actually narrow down your options pretty quickly, and good plans do exist.

In this article, we focused specifically on plans which provided coverage for basic water sports activities such as snorkeling and scuba diving. We personally don’t travel unless our insurance covers those activities which we love to do so much. The cost of paying for insurance each time is comparatively cheaper than the cost we’d have to pay out of pocket for medical expenses if we aren’t insured. We don’t ever see it as a waste of money.

Furthermore, the scope of this article was limited to travel medical insurance plans that covered snorkeling and scuba diving, however there are obviously many more activities you can be covered for. You will also be covered for things like trip delays and cancellations, which sometimes do happen as well. There’s so much that can go wrong on a trip, and you would be crazy not to insure yourself before traveling abroad.